The Real Story Behind West Island Realty

From watching Cape Coral’s Units 67 & 69 fill with development to tracking Thursday morning foreclosure auctions, here’s how 30+ years of obsessive market observation became Southwest Florida’s most specialized real estate practice.

The Thursday Morning That Changed Everything

For years, I’d watch the foreclosure auctions every Thursday at 9 AM. Same routine: 2-3 minutes and everything went to third-party buyers. I could set my watch by it. Then one Thursday in 2024, I came back from running errands at 1 PM and the auction was still going. I thought, ‘Good Gravy, what the hell happened?'”

That was the moment I realized Southwest Florida’s REO market had fundamentally shifted. After watching 96-98% of properties go third-party for years, suddenly 50% were going back to the plaintiffs. This wasn’t a blip—it was a $200 million shift in how distressed inventory moves in our market.

Most agents would have missed it entirely. But when you’ve been tracking the same courthouse steps for two decades, you notice when the pattern breaks.

Why I Track What Others Ignore

Cape Coral’s Development Reality:

When builders tell me they’re targeting Units 67 and 69, I pull my Excel spreadsheet of out-of-state lot owners in those exact areas. That’s not generic market knowledge—that’s 30+ years of tracking who owns what, when they bought it, and when carrying costs become unbearable.

The Spec Home Crisis:

We’re looking at what could be 100-200 unfinished spec homes entering the REO pipeline by the end of this cycle. That might not sound like much, but it’s unprecedented—historically, we’ve seen 20-50 unfinished specs over a 4-5 year REO cycle. These represent about 10% of total REO inventory, but they’re the most complex 10% because of permit issues and hard money lending complications.

Probate Timing Intelligence:

I maintain contact with executors for 2-3 years because I know exactly how long it takes families to realize they can’t afford the carrying costs. It’s not patience—it’s pattern recognition from hundreds of similar situations.

The BPO Reality:

When I’m sent 5-20 properties at once, I know they’re not just random assignments. They’re usually connected—same builder, same lender, same problem. That context changes everything about how you price and position these assets. What matters is understanding each lender’s portfolio and risk profile when their assets become REO inventory.

Bob Hagmann: From 16 Crying Agents to Boutique Expert

The Pivot Decision:

I had two choices: ramp up to compete with Century 21 and Re/Max, or stay boutique and specialize in REO, vacant land, and probate. I was tired of 15-16 agents crying every day about retail competition. Now it’s just me and a couple of buyer agents who’ve been with me for years—and they’re fantastic.”

Why I Sold My Office Building:

When you scale down to focus on three specialized markets, you don’t need 5,000 square feet of office space. I sold the building, moved operations to my professional home office, and invested the difference in market intelligence systems that actually matter.

The Postcard That Works:

Everyone wants to know about digital marketing and social media. But I’ve tested everything for 20 years. That “stupid little postcard” to in-state and out-of-state landowners still generates 90% of my vacant land business. When mom and dad die and junior realizes he’s paying Florida property taxes on land he’s never seen, he calls the guy on the card.

Understanding the Current Cycle:

This REO wave isn’t just about unfinished spec homes—that’s maybe 10% of the inventory, though it’s the most complex 10%. The bigger story is four years of pent-up foreclosures hitting the system simultaneously, creating opportunities for asset managers who understand Southwest Florida’s unique market dynamics.

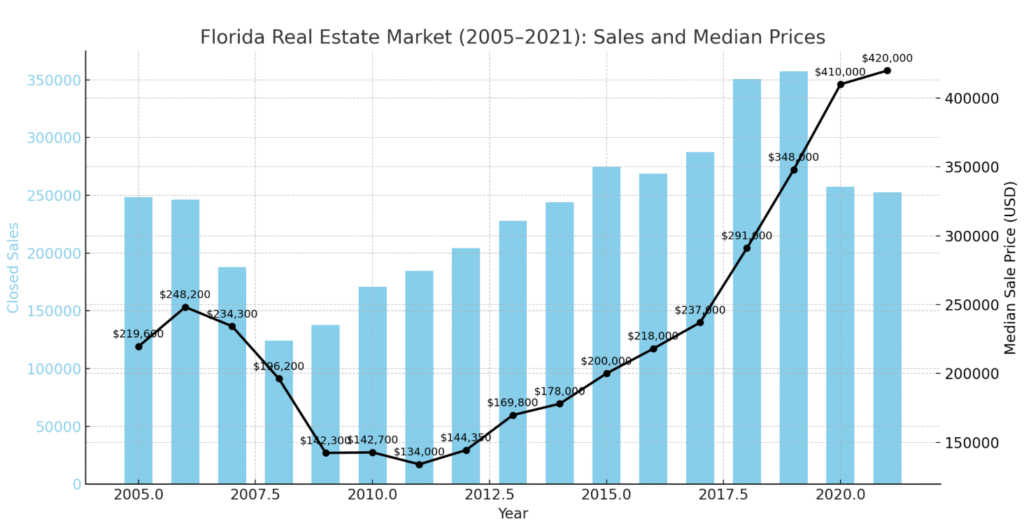

What 20 Years of Boom-Bust Cycles Actually Looks Like

The Three Markets I Understand Well

The Network That Matters

After 20+ years, these aren’t just professional relationships—they’re people who know I’ll deliver accurate information and handle complex situations correctly.

Asset Management Companies:

Asset Val, Ground Floor Partners, and others who know I understand Southwest Florida’s permit complications and construction realities.

Probate Attorneys:

15+ attorneys throughout Southwest Florida who call me for expert testimony because they know I won’t oversell my expertise or make claims I can’t support in court.

Builder Network:

Active developers who tell me their plans because they know I’m not competing for their retail business—I’m helping them find the land they need.

Professional Organizations

Being part of elite professional organizations gives you access to all of their knowledge, experience, and perspectives. This allows me to weigh and research even deeper to give the most accurate picture of the market and my client’s properties, as well as properties you may be considering.

The Buyer Agents:

Two agents who’ve been with me for years and understand that our clients need facts, not hand-holding. They know the difference between seasoned investors and first-time buyers.

Court Personnel:

Clerks, judges, and court reporters recognize my name because I consistently arrive prepared with proper documentation and avoid wasting anyone’s time.